Whether you’re a seasoned homeowner, or someone on the hunt for your very first home, you should know what Property Taxes are and why everyone who owns real estate has to pay them. Read on to find out what can happen if you don’t pay your Property Taxes on time.

If you’ve been renting for a long time, it might come as a surprise to you that Property Taxes are a fairly significant constant and recurring expense that you need to factor in when on the hunt for your first home purchase. On the flipside, if you’re a landlord, you know very well how much you’re spending per month on Property Taxes on any of your properties.

Note to renters: Yes, some landlords may be greedy, and inflate your rent amount each year by much more than is reasonable; however, keep in mind that the costs for owning and maintaining housing rise every year with the normal pace of inflation, AND often experience small spikes due to local tax adjustments or special assessments. Most landlords are just trying to keep up with the bills.

Taxes, as a whole, serve to fund various parts of society that are public services rather than private businesses. Since these various services don’t have a traditional business structure with a stream of revenue from selling goods or services, the public provides that source of revenue directly via various taxes. Essentially, when you pay a tax, you’re paying to keep your city, county, state, and country up and running. There are a variety of taxes that are charged against many different types of transactions and circumstances, which you can easily see an example of if you look at the bottom of your receipt from the department store (sales tax).

Learn More About How Our Process Works!

What’s interesting about city, county, and state taxes, is that they can vary wildly from one place to the next. This is due to the different needs each place has, and what each population deems most important. You might find that a particular city has much higher sales or income taxes than its neighbor, because the city has allocated more funding in its budget towards infrastructure maintenance, or towards keeping the main public areas of the city extremely clean and well-manicured with fresh landscaping throughout the year.

Property taxes are used to fund a host of local public needs, including the fire department, police department, libraries, road construction and maintenance, the local school district, and much more. They serve as a vital source of funding to keep these services alive, and when revenue dips, those services may suffer as a result. Cities may struggle with making decisions on their budgets each year if that happens, and may be forced to make tough choices in reducing access to essential public services. If you’ve ever heard of schools not being able to afford enough supplies for their students, or about them cutting bus routes out, it’s often because they aren’t receiving enough public funding to pay for everything and everyone that they need.

How is the Property Tax on your home calculated?

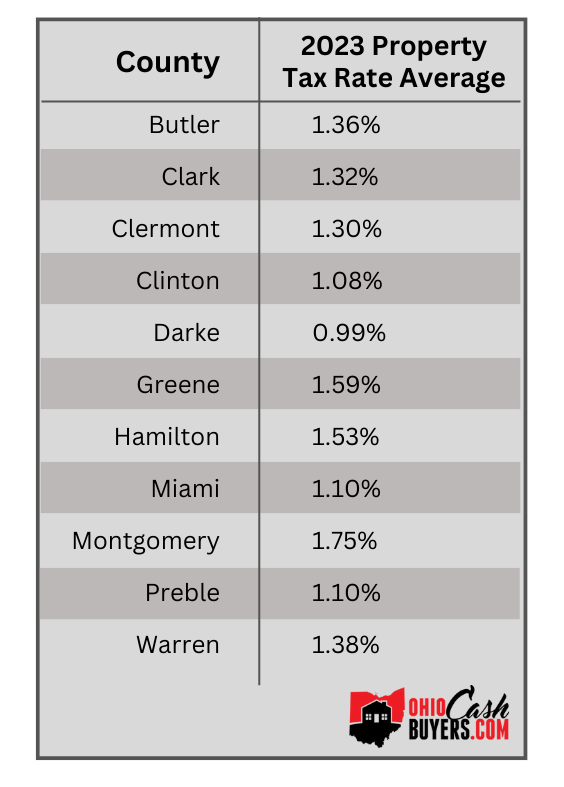

The County dispatches a specialized tax assessor to determine the fair and current market value of your home (usually this happens every couple of years, unless a purchase/sale of the home is completed to trigger a more immediate request for an updated value assessment). Once the value has been determined, the County is then able to assess Property Taxes against that value as a percentage. As mentioned earlier, the tax rate varies from one County to the next.

Let’s take a look at the Counties we regularly buy houses from to better show you some differences:

So what happens if you cannot pay your Property Taxes?

Life happens sometimes, and you can fall behind on paying your taxes. At this point, the home is placed in a “Delinquent Taxes” status, and the County attempts to collect payment from you, with penalties and late fees added on top of your original bill. There is a window of time that you can pay these past due property taxes off and remain in good standing with the County (one calendar year).

However, once that window of time has passed, you will lose all rights to your home, and it will be sold out from underneath of you to satisfy the tax debt. Don’t let that happen to you! If you’re behind on paying your Property Taxes and it’s possible that you won’t get caught back up on them, you need to call us NOW to discuss your options to sell your home and avoid foreclosure. Even if you’re just seeking some information and you don’t seriously think you’ll need to sell your home, you should definitely still talk to us. We have a wealth of knowledge and experience in these situations, and we’re happy to help in any way that we can, whether we buy your house or not.